Comparing Title loan APRs is key for informed borrowing decisions in Houston, Dallas, or San Antonio. By analyzing interest rates, loan terms, and fees, borrowers can assess total financial commitment and make responsible choices for emergency funding. Reputable lenders offer transparency, clear communication, and flexible terms, fostering trust in the title loan process.

When considering a title loan, understanding the Annual Percentage Rate (APR) is crucial for making an informed decision. This article guides you through the key factors that compose a fair title loan APR comparison. We’ll break down how to interpret and evaluate APRs, ensuring transparency and fairness in your search for the best loan terms. By the end, you’ll be equipped to navigate the market confidently and secure a lending agreement that aligns with your financial needs.

- Key Factors in Title Loan APR Comparison

- Understanding Annual Percentage Rates (APR)

- Evaluating Lender Transparency and Fairness

Key Factors in Title Loan APR Comparison

When comparing Title Loan APRs, several key factors come into play, helping borrowers make informed decisions to access emergency funds efficiently. Firstly, the interest rate itself is paramount. This is expressed as a percentage and represents the cost of borrowing. Secondly, the term of the loan influences the overall cost; shorter terms typically result in higher monthly payments but reduce the total interest paid. Understanding these two elements allows individuals, especially those needing Houston title loans or Dallas title loans, to assess the financial commitment involved.

Additionally, fees and charges associated with the title loan should be transparently disclosed. These may include processing fees, administrative costs, or early repayment penalties. The combination of the interest rate, loan term, and fees provides a comprehensive picture of the Title Loan APR comparison, enabling borrowers to make responsible choices for their emergency funding needs.

Understanding Annual Percentage Rates (APR)

Annual Percentage Rate (APR) is a crucial metric when comparing Title loan APRs. It represents the annual cost of borrowing money expressed as a percentage, providing borrowers with a clear understanding of the total cost associated with their loan. When evaluating San Antonio loans or any other type of secured financing like title loans, it’s essential to consider the APR in addition to interest rates. This is because the APR takes into account not only the interest but also various fees and charges that may be associated with the loan, offering a more comprehensive view of financial obligations over time.

A lower APR indicates better value for money and can make a significant difference when it comes to repaying the loan. For instance, in the case of flexible payments, a title loan with a competitive APR could mean saving thousands of dollars over the life of the loan. This is particularly beneficial for borrowers who are considering a loan extension or those looking for a more manageable repayment experience. Understanding and comparing APRs is, therefore, a vital step in making an informed decision when seeking financial solutions like San Antonio loans.

Evaluating Lender Transparency and Fairness

When comparing Title loan APRs, evaluating lender transparency and fairness is paramount to ensuring a borrower makes an informed decision. Transparent lenders clearly communicate their interest rates, fees, and loan terms, allowing borrowers to understand the full cost of the loan. This includes breaking down how the Annual Percentage Rate (APR) is calculated and any potential penalties for early repayment or default. Fairness involves offering competitive rates, flexible loan terms tailored to individual needs, and avoiding deceptive practices.

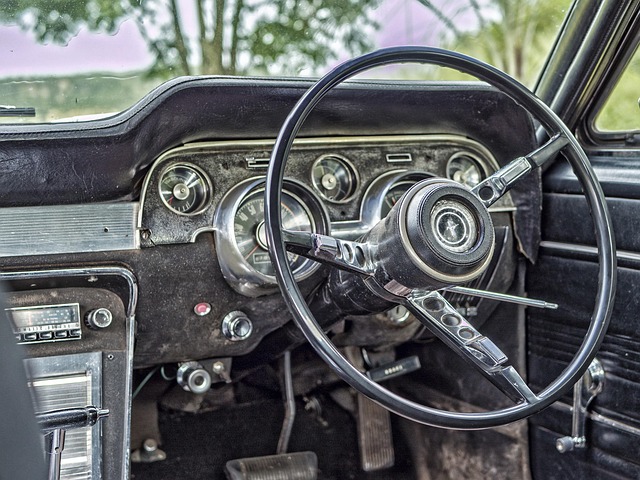

A reputable lender will consider factors like the Vehicle Valuation when determining APRs, ensuring that the interest reflects the value of the asset securing the loan (in this case, the truck). Additionally, they should provide borrowers with options for different Loan Terms, enabling them to choose a repayment period that aligns with their financial capabilities. Such practices foster trust and promote responsible borrowing, making it easier for borrowers to navigate the complexities of Title loan APR comparisons.

When comparing title loan APRs, a fair assessment considers key factors like interest rates, borrowing limits, repayment terms, and lender transparency. Understanding Annual Percentage Rates (APR) is crucial for gauging the true cost of borrowing. Evaluating lender fairness ensures borrowers access to clear, competitive rates without hidden fees or deceptive practices. By focusing on these aspects, consumers can make informed decisions when it comes to title loan APR comparison, ultimately securing the best terms for their financial needs.