When considering a title loan with bad credit, understanding Annual Percentage Rate (APR) is key as it reflects total borrowing costs. Compare APRs from different lenders to secure favorable rates, influenced by vehicle value, financial history, and online/in-person application methods. Lowering interest rates through thorough vehicle inspections or refinancing can significantly reduce overall costs.

“Title loans can offer quick cash for borrowers with bad credit, but understanding the associated costs, especially the Annual Percentage Rate (APR), is crucial. This article aims to demystify title loan APRs and empower borrowers with strategies to navigate this financial instrument wisely. By comparing different rates, borrowers can make informed decisions. We’ll explore key factors influencing APRs for those with poor credit, providing insights into how to secure more favorable terms on these short-term loans.”

- Understanding Title Loan APR: What Borrowers Need to Know

- Factors Influencing APR for Bad Credit Borrowers

- Strategies to Lower Your Title Loan Interest Rates

Understanding Title Loan APR: What Borrowers Need to Know

When considering a title loan, understanding the Annual Percentage Rate (APR) is crucial for borrowers with bad credit. The APR represents the total cost of borrowing expressed as a yearly percentage, including interest and fees. It’s a key metric that allows you to compare different loan offers transparently. A lower APR means less interest you’ll pay over time, saving you money.

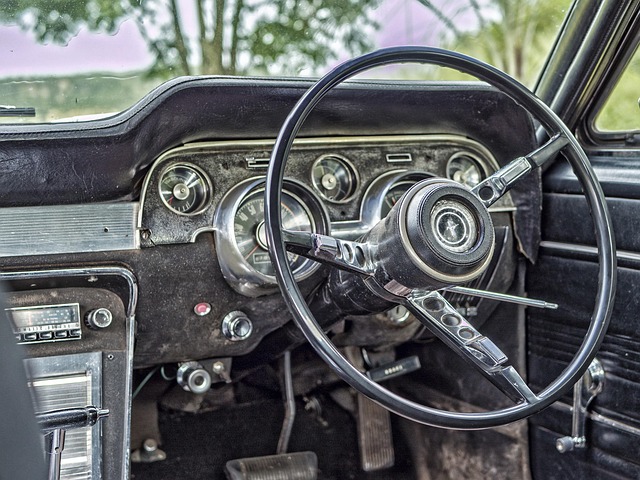

The title loan process involves using your vehicle’s title as collateral, which can make approval easier for those with poor credit. Lenders offer these loans as a form of emergency funding, but it’s essential to be aware of the associated costs. The APR includes not only the interest rate but also various fees charged during the loan term. By thoroughly reviewing the terms and calculating the effective APR, borrowers can make informed decisions and choose the most favorable option among boat title loans or other similar financial products.

Factors Influencing APR for Bad Credit Borrowers

When comparing title loan APRs for borrowers with bad credit, several factors come into play. These include the lender’s assessment of your vehicle’s value and its condition, your ability to repay the loan based on your financial history, and the state laws governing these loans. Lenders also consider the risk associated with extending credit to individuals with poor credit scores, which often results in higher interest rates.

An important aspect to keep in mind is that while a bad credit loan might offer quicker access to funds compared to traditional banking options, the title transfer process can vary across lenders. Some may require you to physically visit their office, while others provide the convenience of an online application. This flexibility can also impact the overall cost, as digital platforms often streamline fees and rates. Understanding these dynamics is crucial when navigating a title loan APR comparison to ensure you get the best possible deal tailored to your situation.

Strategies to Lower Your Title Loan Interest Rates

When considering a title loan with bad credit, lowering your interest rate can significantly impact your overall cost. One effective strategy is to compare Title Loan APRs from different lenders before making a decision. Lenders often have varying interest rate structures and terms, so shopping around can help you secure the best deal. Conducting a thorough vehicle inspection can also influence your loan terms. A well-maintained or high-value vehicle might qualify for lower rates.

Additionally, exploring options like loan refinancing could be beneficial if you have some equity in your vehicle. Refinancing allows you to replace your existing title loan with a new one at potentially lower interest rates. However, be mindful of associated fees and ensure the refinanced loan suits your financial situation better. Bad credit loans inherently carry higher interest rates, but understanding these strategies can help borrowers navigate the process more effectively.

When considering a title loan with bad credit, understanding and comparing the APR is crucial. By being aware of the factors influencing interest rates and employing strategies to lower them, borrowers can make informed decisions. A thorough title loan APR comparison allows individuals to find the most favorable terms, ensuring they access the necessary funds while managing their finances responsibly.